Analysis: Oil price fixing

With gasoline prices on the rise, many drivers are upset over the extra drain on their wallet.

May 6, 2022

Senior Peter Stern pulls into a gas station on his way to school to refill his car. He drives past a sign displaying gas prices. Removing the pump from its handle, he sees a sticker: President Joe Biden pointing to the prices saying “I did this.”

This is a common sight for many drivers across the country. Not only more expensive gas prices but claims that they are the byproduct of anti-oil legislation, or of President Biden’s handling of the conflict in Russia, one of the western world’s main providers of oil. Both claims are equally unsubstantiated and untrue. In reality, the higher gas prices have nothing to do with fiscal governmental policy or overseas conflicts. Instead they are the result of market manipulation by large oil corporations.

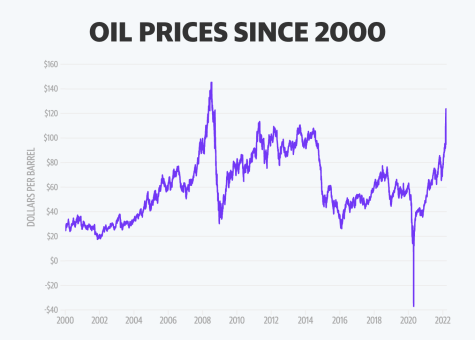

The reasoning behind this lies in the simple economic principle of supply and demand. When there is less of a certain good or service being provided to the same amount of — or even more — people, the price of that good increases. The opposite is true when there is more of that good or service, meaning that an overproduction of oil leads to lower prices. In 2011, an immense overproduction of oil led to one of the largest dips in gas prices in recent American history. Today’s higher prices are part of an effort by these corporations to combat that decade-long struggle. Rather than accept diminishing returns, or compete with one another to sell their product at a lower price, oil companies have coordinated with one another to set the price of their product at a rate they deem profitable.

This is not something that drivers like Peter should expect to go away soon. While the price fixing of gasoline is a perfect example of market collusion and therefore inherently illegal, oil conglomerates are rarely held accountable. In many ways, the relatively low prices that drivers have experienced since 2011 have been as much an aberration from the norm as the higher prices are now, and the oil companies who suffered from that see the current augmentation of prices as the best way to recover from that loss.

In many ways, this is the new normal. Whether politicians elect to enact stricter legislation regarding foreign oil corporations, or even move to harvest oil domestically, it is clear that this issue will be a matter of contentious debate in the coming elections and political conversations.