Time to save: Figure out finances for secure future

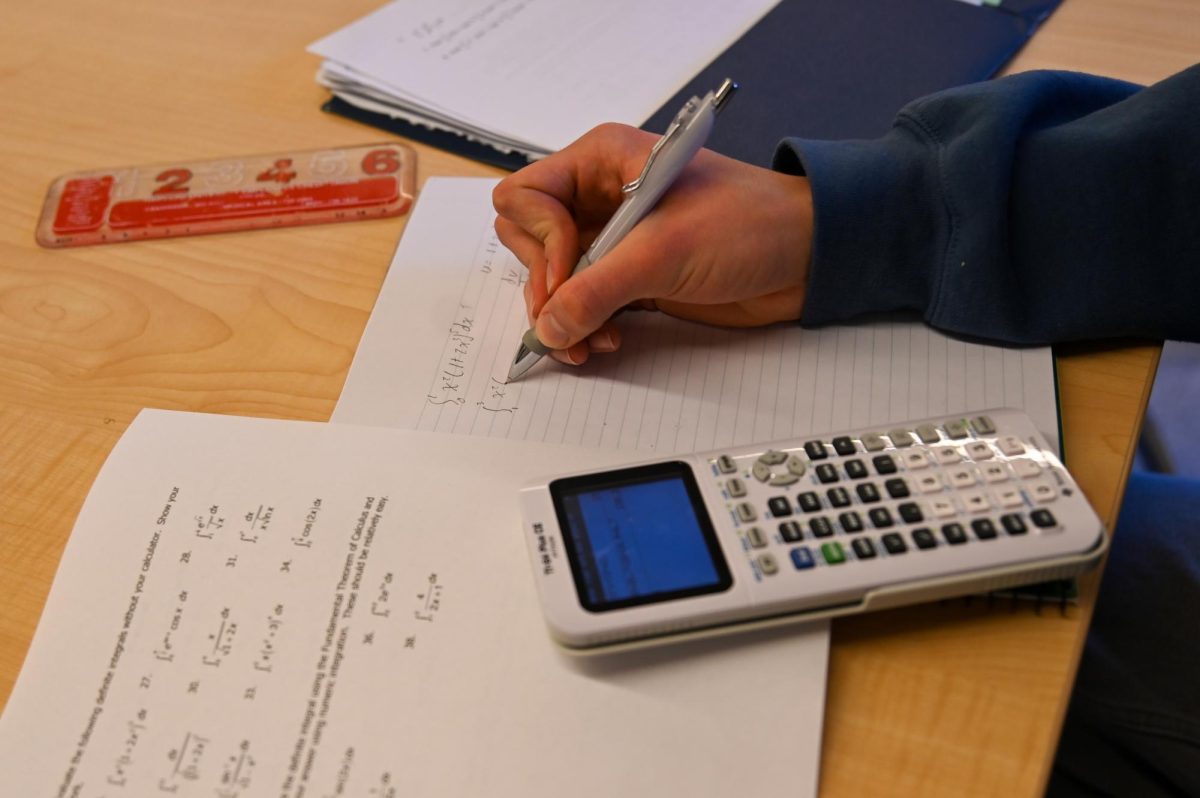

FUN WITH FINANCE. Through educating themselves on basic personal finance, students can save money while preparing for their future.

March 31, 2023

While the concept of saving money might seem somewhat irrelevant when parents or guardians are likely taking care of most expenses and many of us aren’t yet actively employed, learning to save now can be beneficial as we mature and become financially independent.

The main reason for learning how to save now is because we currently have limited spending requirements, and most of us have the benefit of having parents or caregivers that pay for most of our spending needs. This cushion allows us to learn without the risk of running into financial problems.

The concept of saving is simple: You cut back on some spending today so you can use that amount to be spent later. This principle demonstrates that sometimes less is more.

There are a couple of easy ways to start saving:

- Use student perks: Many businesses offer perks and discounts to students, extending to food, retail and entertainment. Students simply have to present a viable school email or high school ID. Some offerings for high schoolers include: Nike, Hollister Co., Urban Outfitters, Levi’s, Oakley, AMC Theatres and Krispy Kreme. There are tons more for university students. Hyde Park restaurants Saucy Porka and The Sit Down are among those that offer a 10% student discount. In general, when shopping or dining in areas with a lot of university students, like Hyde Park, South Loop or Lincoln Park, ask if they offer a student discount.

- Use tracking apps: Many apps allow students to keep track of their money in one place. Some are specially designed for younger consumers and those new to saving, including Greenlight, Acorns and FamZoo. These apps give students the infrastructure to manage their spending in a way easily maintained by the guidance of a guardian to learn about topics such as recurring expenses, allowance and incentives, spending tradeoffs and even investing.

- DIY: Why spend money on something you can do yourself? For instance, instead of buying an iced coffee at a shop every day, perhaps buy the ingredients separately and make your own. The same goes for lunch. While this option isn’t feasible for everyone, it’s a good habit to take note of — one that can have a greater impact than you might think.

The bottom line: Saving and thoughtful spending are helpful habits that are beneficial at every stage in life. Building these habits now, either in increments or through various methods of goal setting, is a smart way to set yourself for a financially aware future.