Fast check: Your personal finance questions answered

Understanding the works of financial literacy is becoming increasingly more important. However, it is a topic many do not understand well.

May 3, 2022

Cash. Credit Cards. Checking accounts. Money is all around you, and though students may think they understand personal finance, a Midway poll shows there are still many knowledge pitfalls. So, before you venture off into the world and suddenly find yourself face to face with serious financial decisions in an increasingly digital economy, here is the basic financial knowledge you need to know.

What is credit?

Credit is when another entity provides you a loan that you are contractually obligated to pay back, often in monthly payments. While credit is often negatively associated with credit cards, a responsible use of credit helps to establish a positive credit history, according to Rebecca Maxcy, Director at the University of Chicago Financial Education Initiative.

Why should I care about credit?

Credit is important because it provides expanded access to financial resources, which gives the flexibility to do more with your money. With a good credit history, you can find reduced interest rates on loans for big purchases like a car or eventually a house, and improved credit card benefits.

Charles Disantis, AT Economics teacher, said that the three factors to determine a credit score are reliable payments, length of credit and credit utilization.

If you have a credit card, make sure to completely pay off any remaining balance at the end of each month, and do not quickly cycle through new credit cards.

However, many young people have no credit history — that is, they have no record of financial payments or debt, so they cannot take out loans.

How can I build my credit?

The current credit system is circular, which can mean that people need to take a small loan from a credit card company or bank in order to start their credit history, but the simplest way to build credit is to pay a utility bill in your name, suggests college counselor Stephan Golas.

Other ways to gain credit history include having a part-time job or taking a small federal government loan of $250 for college.

Should I have my own credit card in college?

Ms. Maxcy and Mr. Disantis recognize that getting a credit card is a family decision, so if you do try to get your own credit card, they recommend first having a transparent discussion with your family about finances to avoid any surprises.

Mr. Golas does not recommend getting a credit card unless it has a low credit limit (around $500) to avoid spiraling into a financial hole.

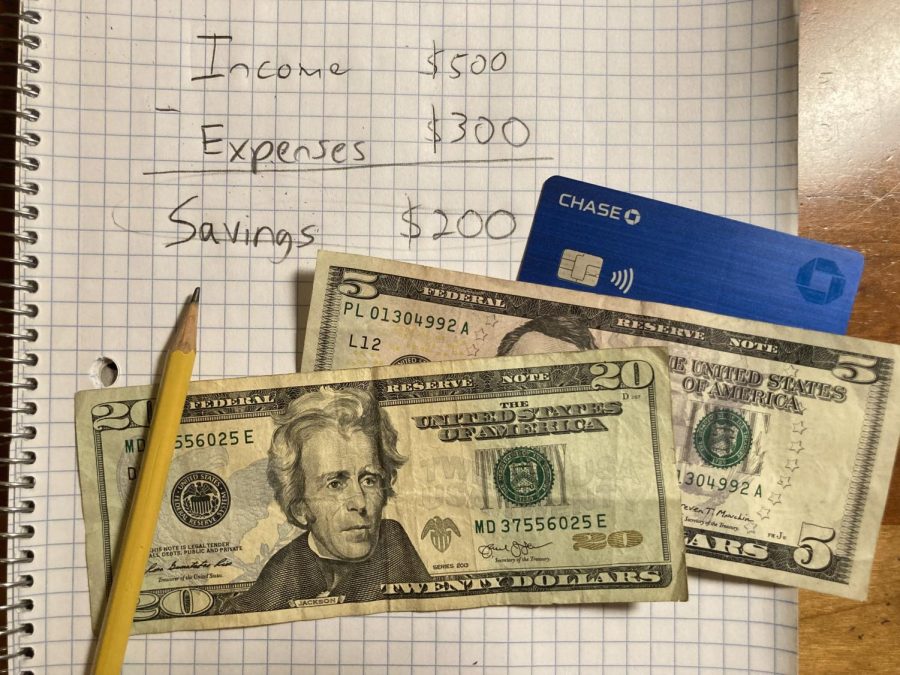

How should I save and budget post-high school?

Mr. Disantis and Ms. Maxcy do not advocate using a budgeting rule of thumb, like the 50/20/30 rule, because it is not always possible to stick to your budget. Save what you can each month and work towards a saving goal, but at least know where your money is going by looking at your credit and debit card records, so you understand your budget.

“I think a lot of people that have a credit or a debit card and they simply swipe it,” Mr. Disantis said. “They don’t think about how much it is, they don’t think about how much it is per month, they don’t think about what percentage of their budget it is.”

Mr. Golas tracks his monthly income and expenses with a Google spreadsheet and keeps his long-term plans in mind, like traveling or buying a house, to help him keep his saving goal on track.

“Sometimes we just are so focused on what’s right in front of us that we forget that there are other things in our future that we might also want to be working towards,” Mr. Golas said. “And it’s never too early to start thinking about those things.”

Should I know how to invest?

Mr. Disantis and Ms. Maxcy reiterated that knowing the nuances of stock trading is not necessary— rather a general understanding of basic investment options, like stocks, bonds and index funds, is more important.

While you may not be in college, it is still important to learn about personal finance because there are costs beyond tuition, housing and meals, like entertainment, laundry and haircuts, that are not included in the bill. And staying informed and understanding your financial decision tendencies will help you prepare for those decisions in life post-high school, and understand the value of $1.

“Growing conscious of actually what the value of $1 really is,” Mr. Golas said, “is something that I think students, once they embrace that, I think they fully appreciate their blessings in life.”